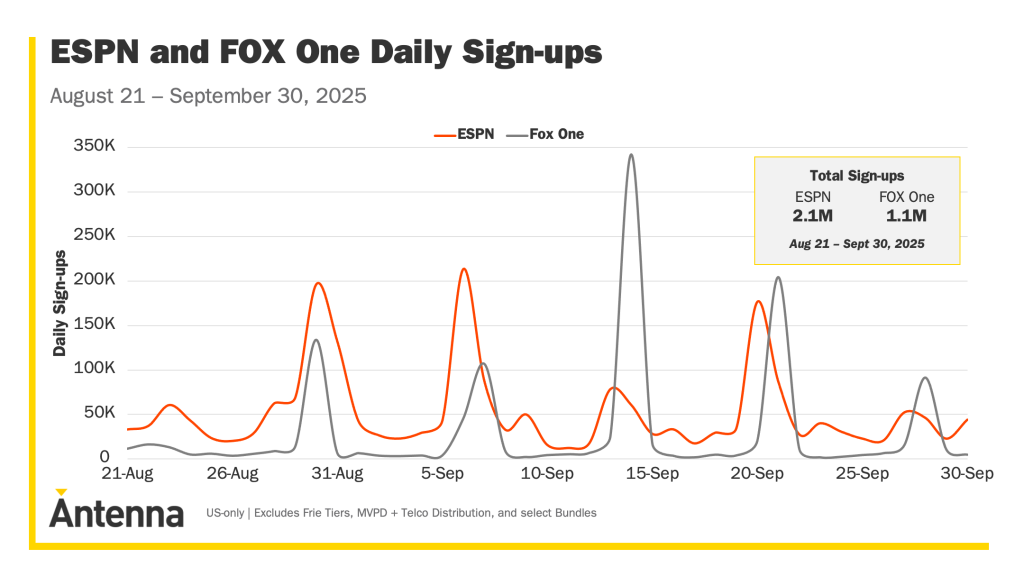

FOX One, Fox Corporation’s long-teased direct-to-consumer bundle of news, sports, and entertainment, pulled in roughly 1.1 million sign-ups in its first 30 days.

Those early numbers came from Antenna’s market telemetry. They were also widely reported by industry outlets tracking the DTC (direct-to-consumer) rollouts across the fall window.

A quick recap of FOX One

The Fox One DTC platform launched on August 21, 2025, for $19.99 per month or $199.99 per year with a 7-day free trial.

The service bundles live and on-demand access to Fox’s portfolio. This includes the Fox broadcast network, Fox News Channel, Fox Business, Fox Sports brands (FS1/FS2), Fox Weather, the Big Ten Network, local Fox stations, and select premium offerings.

Pete Distad, CEO of Fox’s Direct-to-Consumer division, on launch and its value:

“We’re eager to launch FOX One and super-serve our viewers with the best in live news, sports, and entertainment content all in one place. In bringing together the full power of the Fox content portfolio in one service, we have created a great value proposition and user experience that will appeal to cord-cutters and cord-nevers.”

What the 1.1M number actually includes (and what it doesn’t)

You should treat the Antenna estimate as a directional indicator, not as Fox’s confirmed subscriber tally or revenue figure. Here’s how to read it:

- Sign-ups are not equal to paying, recurring subscribers: Antenna counts sign-ups or activations captured through certain platforms and telemetry. Those sign-ups include trial activations and activations where the purchase may flow through Amazon, Roku, or other partners. Trials convert; some churn immediately.

- Partner channels change the economics: When a user subscribes via Prime Video Channels or Roku Channel, the platform takes a cut. That reduces the total amount Fox receives per sign-up. Reports flagged Amazon Channels as a major source of early sign-ups.

- MVPDs and existing pay-TV deals aren’t fully captured: Antenna’s public numbers exclude subscribers who got the service through legacy pay-TV bundles or MVPD enterprise deals. Those activations are not visible in Antenna’s data pipeline. Fox may report materially different figures internally after aggregating MVPD, promotional, and enterprise activations.

How FOX One compares to competing launches

ESPN’s app launched the same day, and Antenna estimated 2.1M sign-ups in the first 30 days. This is roughly double FOX One’s pace.

ESPN’s sports portfolio of league rights and exclusive studio shows resonates heavily with live sports die-hards, which explains the difference. Still, FOX One’s mix of news, sports, and entertainment gives it a broader appeal.

Big streamer rollouts typically show a spike of sign-ups early on from promotional curiosity and free trials. They then flatten as markets mature. What matters next is retention past day-30, month-3, and month-12.