ESPN’s direct-to-consumer (DTC) streaming launch has vaulted past expectations in its opening month.

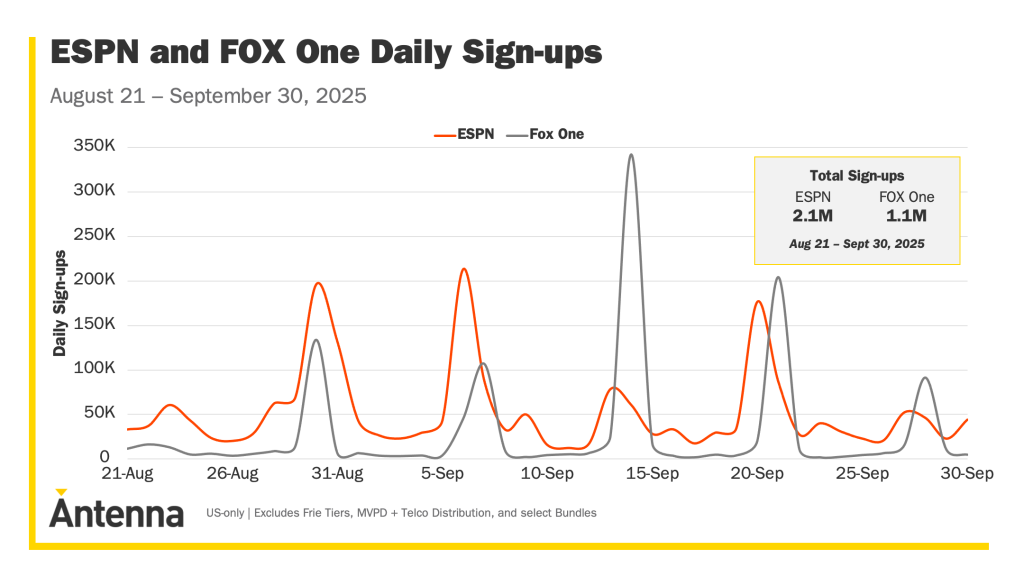

Industry measurement firm Antenna and multiple trade outlets estimate the new ESPN app signed up roughly 2.1 million consumers between launch and the end of its first full month.

That number includes full-price subscribers who use ESPN’s new “Unlimited” tier and consumers who chose the more limited ESPN Select. It does not capture every way people can access the brand’s channels or content.

For instance, viewers who gain access through MVPD deals or legacy Disney bundle transitions.

What ESPN launched, when, price points, and the official spin

ESPN launched its new DTC streaming product and an upgraded ESPN App on August 21, 2025, timed to the start of the college football and NFL seasons.

The company offered two headline consumer options at launch:

- An Unlimited plan priced at $29.99/month at introductory terms that includes access to ESPN’s full suite of 12 linear channels and services.

- A lower-tier option, ESPN Select, akin to the previous ESPN+, which bundles a narrower set of content and originals.

The streaming service bundled launch offers, including combinations with Disney+ and Hulu, and special pricing for early adopters.

The company leadership’s strong language sells the strategy. Jimmy Pitaro, ESPN’s chairman, notes:

“This is a monumental day for all of us at ESPN, for The Walt Disney Company and, most importantly, for our fans… We’ve put a lot of hard work into this launch, with the full force of ESPN and Disney behind it, and we can’t wait for fans to experience.”

Adam Smith, Chief Product & Technology Officer, Disney Entertainment & ESPN:

“ESPN is the preeminent digital sports platform, and this launch marks the most significant advancement of the product in years… This new era kicks off at a time of incredible momentum at ESPN, and across Disney’s streaming business and products.

Where the 2.1M number comes from

Antenna’s reporting has become a common early industry benchmark for new streamer launches. It provides fast visibility into consumer behavior but also carries methodological limits.

Early data and reporting indicate the initial sign-ups split across tiers and channels:

- About 1.2 million of the estimated total favored the full Unlimited tier, which is the higher-priced offering that includes all linear networks.

- The rest (800k) opted for the cheaper ESPN Select/ESPN+ style package or came through promotional deals.

You don’t need a spreadsheet to see why the company emphasized the Unlimited tier. The network anchors massive rights portfolios. They cover NFL windows, NBA, MLB, college conferences, UFC, WWE, and major tennis and soccer rights. Every fan wants uninterrupted linear access for an affordable price.

Industry trackers and reporting show weekend spikes tied to marquee events and major college football weekends drove discrete surges in sign-ups. Certain wrestling or pay-per-view adjacent events, like WWE-related premium events, that streamed on the platform also caused spikes.

ESPN didn’t launch alone

Fox launched Fox One simultaneously, and industry trackers estimate Fox One pulled roughly 1.1 million sign-ups in the same period. That makes ESPN’s debut materially larger, but both launches show that the marketplace will accept paid direct sports/news options beyond the legacy bundle.

Fox’s share leaned more on Amazon Channels and promotional channels, according to early reporting. ESPN leaned on its rights portfolio and the Unlimited tier’s access to multiple linear channels.